May 29, 2025

Time for Another Look at Underwriting Reputation Risk

Two recent lawsuits alleging director and officer liability have also called for board refreshment because of culpability. This emerging strategy to pressure directors to settle exposes directors to going-forward personal financial and reputation loss that is rarely covered with conventional liability insurance and is not yet widely covered with reputation insurance.

Inveighing against directors personally with an innovative strategy, plaintiffs allege in a recent stock price drop case that Target’s board is both illegitimate and an ongoing threat to the firm’s reputation and value. The complaint strategically tars the personal reputations of Target board members.

The new personal twist in the Target stock price drop suit borrows language typically seen in proxy fights—alleging false and misleading proxies constituting a violation of Section 14(a) of the Exchange Act and SEC Rule 14a-9. It creatively alleges that the board, having been elected through fraud, is responsible for damaging the firm’s reputation, a stock price drop, and, critically, going forward damage. “If a Board had been elected that was prepared to exercise proper oversight of the risks … (the Company’s reputation would not have been damaged and) Target’s stock price would not have declined throughout this period.”

A more recent derivative case on behalf of Wells Fargo explicitly alleges that “persistent malfeasance” lasting around a decade has “ruined Wells Fargo’s reputation and its relationship with investors, regulators, and consumers.” Because “each Individual Defendant aided and abetted and rendered substantial assistance” in the litany of wrongs, in addition to the usual forms of relief, plaintiffs are seeking to nominate three candidates for election to the Board.

They have a saying in Chicago: “Once is happenstance. Twice is coincidence. The third time it’s enemy action.”

There will be a third. This new strategy is a risk-free infliction of coercive pain. It potentially exposes Directors and Officers to personal losses beyond the penumbra of D&O liability insurance. For the liability underwriting community, it’s a good time to take a fresh look at reputation risk, its hazards, and insurance options.

Seen for years as a risk of negative publicity and sentiment, reputation risk has emerged as mission-critical risk arising from a gap between what stakeholders expect from a company or brand—its principles, commitments, character, and how it operates—and what they experience or perceive, especially in moments of stress, scrutiny, or change. As the forthcoming Reputation Risk Governance: Guiding Principles for Boards from the Directors and Chief Risk Officers (DCRO) Institute notes, the risk that disappointed stakeholders will alter their behaviors and permanently impair a firm’s cash flow is a direct threat to its financial resilience.

Firms are generally aware of the potential cost of reputational damage. In a recent survey by the risk consultant and broker, WTW, it was the eighth most frequently cited top emerging risk to a firm. Surprisingly, the same survey reported that only four out of 10 firms have governance actions in place for emerging risks, even though institutional investors like Blackrock have been calling for compensation clawbacks from any senior executive whose behavior causes material reputational risk to a company.

Now, because litigants are calling for board refreshment, a securities or derivative case may land one or more directors in a painful exit interview and impaired prospects. A report by PwC suggests peers may not come to their aid as 25% of directors surveyed indicated they would prefer seeing one or more of their fellow board members step down.

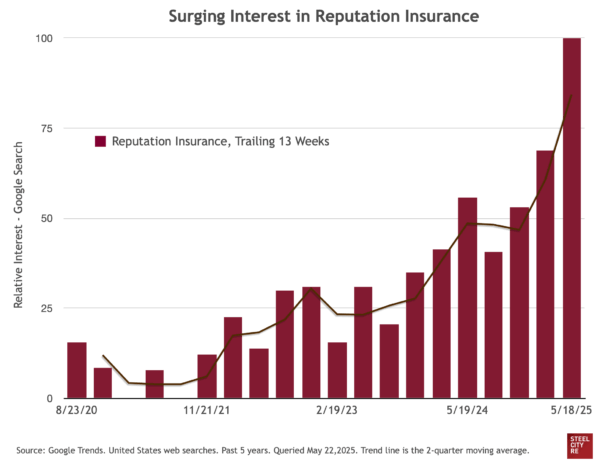

An exiled director’s 1st party losses are typically not covered by most D&O liability insurance policies. And while most boards still don’t carry reputation insurance, interest in this coverage is recently surging. Google Trends reports that searches for reputation insurance multiplied greatly in each of the past two quarters (Figure).

Figure. Surging interest in reputation insurance. Data Source: Google Trends, United States web searches, past 5 years, for the phrase “reputation insurance.” Queried May 22, 2025.

While it brings directors added security, insurance should be the last line of defense for reputation risk. The measure-mitigate-insure sequence for most companies will generally look like this (not legal or risk management advice!):

Measure: The strategies used in the risk and insurance world for reporting instruments are similar to those used increasingly to quantify exposures for index-based insurance. The DCRO Institute guidelines recommend measurement tools that track both issues and their financial impact.

Mitigate: With actionable insights from reporting instruments, directors should ask of their risk managers: is action needed, is it needed now, and does it involve non-exclusively operations, communications, or risk financing and transfer?

Insure: Corporate culpability in a reputation crisis can lead to reputation value losses to both an enterprise and to individuals. Many of these costs will be covered by well-known insurance. However, uncovered going-forward losses that will be sustained by the enterprise and by individual directors and officers might now be covered by parametric reputation insurance—a fact not widely appreciated.

Parametric reputation insurance is a 1st party coverage that can be offered through captives or transferred to the open market. For firms with insurance captives, parametric reputation insurance can be structured within a captive, to front a captive, or to reinsure a captive.

The DCRO Institute’s Reputation Risk Governance: Guiding Principles for Boards asserts that boards which govern reputation risk explicitly—not incidentally—are better positioned to strengthen financial resilience, mitigate business and financial volatility, and sustain stakeholder relationships amid complexity and disruption. Reputation insurance is therefor also Caremark-relevant evidence of explicit mission-critical board oversight.

Meet the Author

Dr. Nir Kossovsky is CEO of Steel City Re, where he pioneered parametric solutions for reputation value monitoring, risk management, and re/insurance. Previously, he was CEO of the venture-backed real options-based platform for intellectual property assets, The Patent & License Exchange, which was memorialized in a Harvard Business School Case Study. His earlier work as a professor in the UCLA School of Medicine and Deputy Coroner in LA County is documented in a Darden Business School Case Study. He has served as a Trustee of the health system Excela Health and a Director of several other privately held firms. He is the author of Reputation, Stock Price, and You: Why the market rewards some companies and punishes others; and Mission: Intangible. Managing risk and reputation to create value. Dr. Kossovsky was honorably discharged from the US Navy Reserves with the rank of Captain.

Dr. Nir Kossovsky is CEO of Steel City Re, where he pioneered parametric solutions for reputation value monitoring, risk management, and re/insurance. Previously, he was CEO of the venture-backed real options-based platform for intellectual property assets, The Patent & License Exchange, which was memorialized in a Harvard Business School Case Study. His earlier work as a professor in the UCLA School of Medicine and Deputy Coroner in LA County is documented in a Darden Business School Case Study. He has served as a Trustee of the health system Excela Health and a Director of several other privately held firms. He is the author of Reputation, Stock Price, and You: Why the market rewards some companies and punishes others; and Mission: Intangible. Managing risk and reputation to create value. Dr. Kossovsky was honorably discharged from the US Navy Reserves with the rank of Captain.

News Type

PLUS Blog

Business Line

Directors and Officers (D&O), Professional Liability, Risk Manager/Insurance Buyer

Contribute to

PLUS Blog

Contribute your thoughts to the PLUS Membership consisting of 45,000+ Professional Liability Practitioners.

Related Podcasts

Icons & Innovators Episode 2

Icons & Innovators is a podcast series spotlighting influential leaders and forward-thinking…

Related Articles

PLUS London: Advancing a Global Professional Liability Community

PLUS’s mission is to be the global community for the professional liability…

The Year in Review: Key Management and Professional Liability Decisions Issued in 2025 Webinar Recap

In our most recent webinar, panelists discussed recent court decisions that are…

Getting an A in Insurance: Analyzing Antitrust, Admissions, Athletics, and other D&O Issues in Higher Education Webinar Recap

During our most recent PLUS webinar, industry professionals came together to discuss…