September 4, 2025

Weaponized Name Calling: Is Harm Insured?

Board members have thick skins and may shrug off name-calling, but today, personal disparagement can lead to financial ruin. Directors subconsciously sense this. For boards to be effective and attract and retain the best directors, management, corporate advisors, and D&O insurers must adopt new strategies and tools to ensure quality governance.

Directors must be able to govern free from the threat of personal financial ruin, yet many traditional safeguards no longer apply or have disappeared entirely. Public attacks aim to damage a director’s personal reputation and prospects as a means of advancing agendas ranging from equity underperformance, succession mishandling, culpability for a meteoric jury verdict, or identity disparagements such as “male, pale & stale” or “DEI.” Justly, or not, board members are more likely to exit with a scarlet letter and dim prospects.

Strategic public humiliation is a feature of “our awful era of intimidation and political violence[i].” The effectiveness of the intimidation strategies of activist investor Elliott Investment Management is illustrative. In 2021, a lawyer in court offered insight into the mindset of a board under siege:

I think they at least would prefer not to be unceremoniously ousted […] and have to read about it every day in the Wall Street Journal and watch it every day on CNBC This is like, you know, if you don’t play your cards right here, you’re going to end up the losing character in like a Jim Stewart book on every — in every airport bookstore in the world.”

Board members can no longer count on board slates, proxy advisors, or even their peers for protection. The universal proxy has reduced the advantages of incumbents, and proxy advisors now tilt toward activists over management. In the first half of 2025, Institutional Shareholder Services and Glass Lewis backed 69% and 85% of dissident nominees, respectively—up sharply from 29% and 37% in 2024. Collegiality is also waning: a 2024 PwC survey found that one in four directors wished two or more of their fellow board members would step down.

Social media has made it much easier to discover and amplify damaging information about board directors. Elliot launched last year a podcast series to speak directly to shareholders of Southwest Airlines to describe how the board seems “unable to grasp how profound the Company’s credibility deficit with investors has become.” Ten days after the first podcast, Southwest agreed to replace directors with five Elliott nominees. In addition, Executive Chairman Gary Kelly agreed to retire within the month.

Weaponizing name calling to publicly damage a board member’s personal reputation and diminish their prospects works because:

(a) Few are willing to hire an architect whose house is said to have collapsed, or a plumber blamed for leaking pipes[ii]. Humiliating news leaks quickly. We only have to look at the “Coldplay couple” to see an example of this.

(b) AI-driven social media has overtaken television as the dominant news source. Humiliating news can overwhelm other points of view…and the truth.

(c) The court of public opinion requires little evidence to convict[iii].

There are two financial strategies to mitigate the potential for financial harm. Board compensation advisors are recommending hazard duty pay. The Directors and Chief Risk Officers (DCRO) Institute recommends reputation insurance. The Guiding Principles for Reputation Risk Governance: Essential principles for Boards of Directors released in June 2025 says:

As stakeholder expectations and legal standards evolve, so does the threshold for prudent oversight. Boards must understand their personal exposure and consider tools such as reputation insurance alongside D&O liability insurance to protect both the organization and its directors.[iv]

Like cyber and other certain forms of insurance that require certain standards to be met and imply third-party risk oversight, reputational risk insurance telegraphs higher governance quality[v]. Indeed, in Principles of the Law, Compliance and Enforcement for Organizations published this past March by the American Law Institute, reputation risk insurance and its providers are recognized as tools that can help mitigate legal and compliance risk. [vi] The implicit lower risk profile also empirically boosts equity value in “normal” times and reduces equity losses in crises.

The spectrum of benefits from reputation insurance may be especially valuable in the current regulatory climate, where legal, compliance, and reputation risks increasingly converge.[vii]

“If they can be charged, we’ll charge them,” (acting US Attorney) Ed Martin told reporters[viii] earlier this year. “But if they can’t be charged, we will name them.”

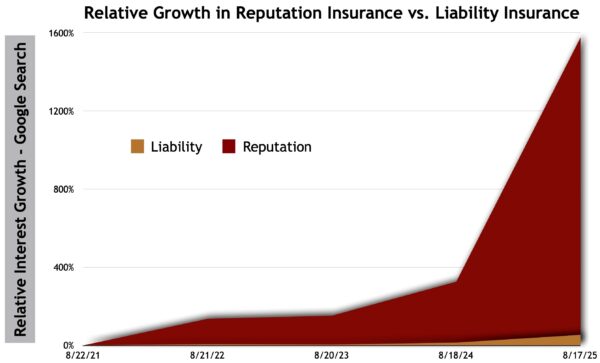

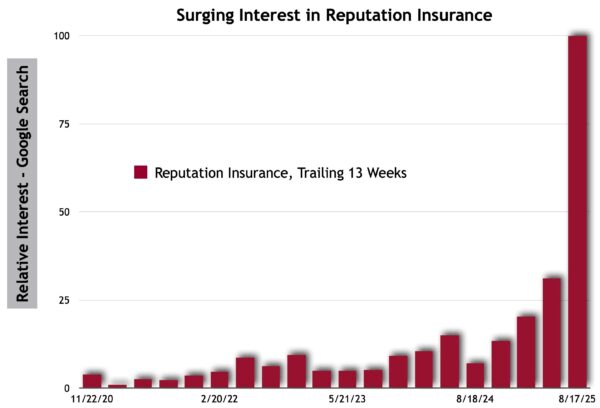

The strategic role for reputation insurance recommended by authorities in law and governance coincides with a rise in online search interest. According to Google Trends, interest in reputation insurance this past quarter is 14 times greater than the same period last year (Figure 1). It dwarfs the increase in interest in D&O liability insurance over the past five years by a factor of 29 (Figure 2).

Figure 1 Interest in reputation insurance this past quarter is 14 times greater than the same period last year. Source: Google Trends. United States web searches. Cumulative values for each of the trailing 13 week periods over the past 5 years. Queried August 17, 2025. Note: Raw Google Trends data represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means there was not enough data for this term. The baseline values for reputation insurance and liability insurance differ. Shown are the period interest over the past five years relative to the respective values for the trailing thirteen weeks ending 8/17/25.

Figure 1 Interest in reputation insurance this past quarter is 14 times greater than the same period last year. Source: Google Trends. United States web searches. Cumulative values for each of the trailing 13 week periods over the past 5 years. Queried August 17, 2025. Note: Raw Google Trends data represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means there was not enough data for this term. The baseline values for reputation insurance and liability insurance differ. Shown are the period interest over the past five years relative to the respective values for the trailing thirteen weeks ending 8/17/25.

Coincidentally, the term “Public humiliation” appeared 500% more often over the past six months on web pages compared to the same period last year—and 1,000% more often than during the equivalent span in 2023, according to a Google term search.[ix]

Figure 2 Growth in interest over the past five years in reputation insurance dwarfs the grown in interest in D&O liability insurance by a factor of 29. Source: Google Trends. United States web searches. Cumulative values for each of the trailing 12 month periods over the past 5 years. Queried August 17, 2025. Shown are the changes over the past five years relative to the respective baseline values for the trailing twelve months ending 8/17/21.

Figure 2 Growth in interest over the past five years in reputation insurance dwarfs the grown in interest in D&O liability insurance by a factor of 29. Source: Google Trends. United States web searches. Cumulative values for each of the trailing 12 month periods over the past 5 years. Queried August 17, 2025. Shown are the changes over the past five years relative to the respective baseline values for the trailing twelve months ending 8/17/21.

Companies also have reputations that need to be protected. In 2018, 450 of the S&P 500 firms disclosed the materiality of reputation risk in their SEC filings.[x]

Warren Buffett, then Chairman of Salomon Brothers, famously warned employees that he would be ruthless if even a shred of reputation were lost. Today, if corporate reputation suffers, the directors’ own reputations are on the line.

A derivative lawsuit against the board of Wells Fargo this past May complained of “substantial financial and reputational harm” to the firm. Because the board allegedly failed to uphold its own governance guidelines and “protect the Company’s reputation, assets, and business” —implying culpability—plaintiffs asked the judge to compel Wells Fargo to allow shareholders to nominate three directors to its board as a remedy.[xi]

Among the allegations against Meta Platforms’ (née Facebook) board in an $8bn derivative lawsuit[xii] this past July were that corporate reputational risks were correctly anticipated, disclosed, but ultimately not effectively managed; and being allegedly mission critical to Facebook, not dutifully governed.

Reputation risk is prevalent and harmful. Unmitigated, it may bring back the awful period in the mid 1980’s when D&O liability turned directorships into “the job nobody wants, [xiii].” At that time, liability insurance proved to be mission-critical. Today, that role will likely be assumed by reputation insurance.

Post Script: For boards, overseeing reputation risk is no longer optional—it is mission-critical. UnitedHealthcare Group, already burdened by reputational headwinds and now facing the extraordinary consequence of its CEO’s assassination, has responded in late August by establishing a board-level Public Responsibility Committee. Its mandate to “monitor and oversee financial, regulatory, and reputational risks” signals a recognition that reputational oversight must be elevated alongside financial and legal governance. Finance and legal executives will likely provide support, but a central governance question remains unresolved: will reputation risk be housed within enterprise risk management, corporate communications, or a newly defined reporting channel? The answer will shape how effectively the board integrates reputation into its broader risk oversight framework.

References

[i]French D. 2025 This Is No Way to Run a Country, New York Times Aug. 7. Available at https://www.nytimes.com/2025/08/07/opinion/judges-courts-threats-fear.htm

[ii] Gapper, J. 2016. Your brand is more fragile than you think. Financial Times, August 3.

[iii] Prosecutors in the Court of Public Opinion, 57 Duq. L. Rev. 271 (2019). Available at: https://dsc.duq.edu/dlr/vol57/iss2/4 (Even prosecutors may vilify uncharged third parties outside of formal judicial filings and proceedings under the Model Rules of Professional Conduct.)

[iv] DCRO Institute Reputation Risk Governance Council. Guiding Principles for Reputation Risk Governance. Essential Principles for Boards of Directors. DCRO Institute, June 2025. p20.

[v] Michael Spence received the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2001 for developing the theory developed the theory of “signaling” to show how better-informed individuals in the market communicate their information to the less well informed to avoid the problems with adverse selection. Available at: https://www.nobelprize.org/prizes/economic-sciences/2001/spence/facts/

[vi] § 4.10. Strategies for Addressing Compliance Risk. c.(h). Principles of the Law, Compliance and Enforcement for Organizations. 2025 American Law Institute.

[vii]Thrush G. and and Barnes. JE. 2025 Gabbard’s Attacks on Obama Put the Attorney General in a Tough Spot. New York Times July 24. Available at https://www.nytimes.com/2025/07/24/us/politics/trump-obama-gabbard-bondi.html

[viii]https://archive.org/details/CSPAN_20250514_091500_Acting_U.S._Attorney_Ed_Martin_Holds_News_Conference

[ix] Google Search. Three-month intervals. All sources. Queried August 1, 2025

[x] Muscavage N. 2025. Meta Board Settles ‘Costly and Embarassing’ Shareholder Lawsuit. Agenda, July 25. Available at: https://www.agendanews.com/c/4927904/675814

[xi] Verified Stockholder Derivative Complaint. In Re Wells Fargo. C.A. No 2025-0517. May 9, 2025.

[xii] Second Amended and Consolidated Verified Stockholder Derivative Complaint. In Re Facebook Inc. Derivative Litigation. Consolidated. C.A. No. 2018-0307-JRS. November 4, 2021.

[xiii] Baum, L., Byrne, J.A., 1986. The job nobody wants. Business Week, September 8, 56-61.

Meet the Authors

Dr. Nir Kossovsky is CEO of Steel City Re, where he pioneered parametric solutions for reputation value monitoring, risk management, and re/insurance. Previously, he was CEO of the venture-backed real options-based platform for intellectual property assets, The Patent & License Exchange, which was memorialized in a Harvard Business School Case Study. He is the author of Reputation, Stock Price, and You: Why the market rewards some companies and punishes others; and Mission: Intangible. Managing risk and reputation to create value.

Dr. Nir Kossovsky is CEO of Steel City Re, where he pioneered parametric solutions for reputation value monitoring, risk management, and re/insurance. Previously, he was CEO of the venture-backed real options-based platform for intellectual property assets, The Patent & License Exchange, which was memorialized in a Harvard Business School Case Study. He is the author of Reputation, Stock Price, and You: Why the market rewards some companies and punishes others; and Mission: Intangible. Managing risk and reputation to create value.

Susan Holliday is a board director and advisor. She is currently a member of the advisory board of Xyant Services, a technology company, and has served as a director on seven corporate boards. Prior to this she was a principal insurance industry specialist at the IFC (Wolrd Bank) and Head of Strategy and Head of Investor Relations at Swiss Re. She is a Qualified Risk Director® and holds the Harvard Business School Corporate Director Certification and NACD.DC

Susan Holliday is a board director and advisor. She is currently a member of the advisory board of Xyant Services, a technology company, and has served as a director on seven corporate boards. Prior to this she was a principal insurance industry specialist at the IFC (Wolrd Bank) and Head of Strategy and Head of Investor Relations at Swiss Re. She is a Qualified Risk Director® and holds the Harvard Business School Corporate Director Certification and NACD.DC

News Type

PLUS Blog

Business Line

Directors and Officers (D&O), Professional Liability

Contribute to

PLUS Blog

Contribute your thoughts to the PLUS Membership consisting of 45,000+ Professional Liability Practitioners.

Related Podcasts

Icons & Innovators Episode 2

Icons & Innovators is a podcast series spotlighting influential leaders and forward-thinking…

Related Articles

PLUS London: Advancing a Global Professional Liability Community

PLUS’s mission is to be the global community for the professional liability…

The Year in Review: Key Management and Professional Liability Decisions Issued in 2025 Webinar Recap

In our most recent webinar, panelists discussed recent court decisions that are…

Getting an A in Insurance: Analyzing Antitrust, Admissions, Athletics, and other D&O Issues in Higher Education Webinar Recap

During our most recent PLUS webinar, industry professionals came together to discuss…